Our Impact at 29th Street Capital

29th Street Capital strives to make positive economic, social, and environmental changes for the local community and real estate markets. At 29th Street Capital, our team of professionals are driven by and follow our strengths bringing the market a multifamily industry-leading company.

Follow us to see what’s happening in the news for 29th Street Capital and our communities.

29th Street capital in the Press

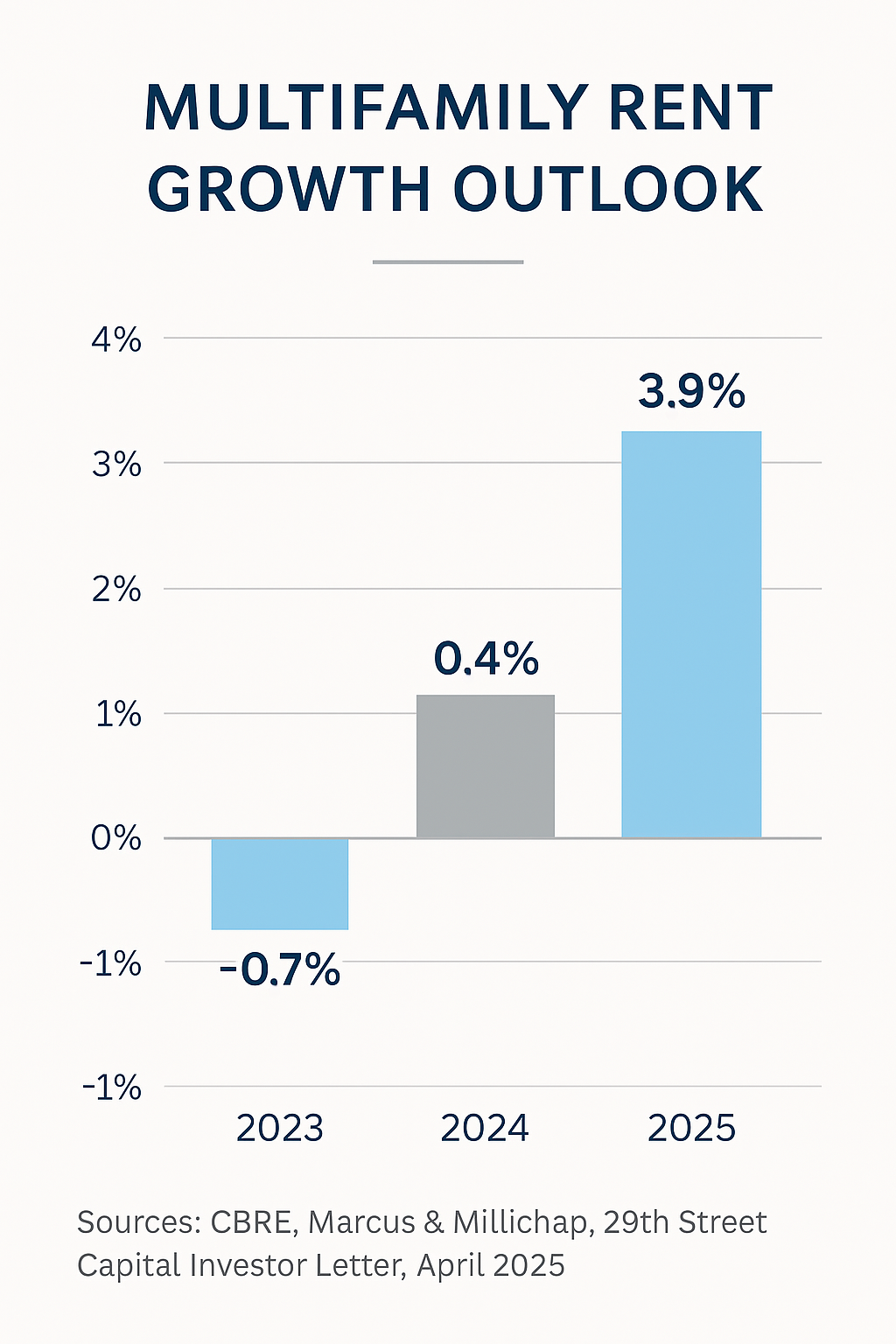

Multifamily Rent Growth Outlook: Why 2025 is a Turning Point for Apartment Owners

After several turbulent years shaped by rising interest rates, inflationary pressures, and a wave of new apartment deliveries, 2025 marks a welcome shift in momentum for multifamily owners. Rent growth is rebounding, supply is tightening, and demographic tailwinds continue to support long-term demand. For apartment owners navigating operational complexity and capital market headwinds, the year ahead presents both challenge—and opportunity.

Rent Growth Is Returning

Multifamily rent growth is poised to rebound in 2025 after a sluggish 2023–24. Class B and C suburban properties are benefitting from affordability constraints and increased renewal conversion rates. According to CBRE and Marcus & Millichap, net absorption is expected to match new supply—marking a shift to a landlord-friendly market for the first time in years.

Sources: CBRE, Marcus & Millichap, 29th Street Capital Investor Letter, April 2025

The Key Drivers of the Upswing

- New Supply Is Drying Up: Permits are down 30–40% since 2022, meaning deliveries will plummet by 2026.

- Affordability Gap Is Widening: Homeownership now costs $1,200–$1,500 more per month than renting in many metros (Freddie Mac, 2025).

- Renter Demographics Stay Strong: Millennials and Gen Z continue to rent longer due to lifestyle preferences and elevated mortgage rates.

Smart Operations Will Define the Winners

With the right tools and team, owners can not only ride the rent growth wave—but accelerate it.

At 29th Street Living, we’ve invested in leading-edge tools and real-time intelligence to drive performance:

- Rentana, our new revenue management platform, enables dynamic, data-backed pricing decisions to optimize NOI.

- HelloData provides granular visibility into local market comparables, enabling proactive rent setting that reflects actual submarket trends.

- Our centralized BI dashboard promotes portfolio-wide transparency and empowers teams to act on insights in real time.

Combined with local leasing intelligence and disciplined renewal strategies, we help owners stay ahead of trends—not react to them.

The Case for Third-Party Management

Apartment owners need partners who understand not only market timing—but also how to translate market data into measurable returns.

That’s where 29th Street Living comes in.

We offer:

- Proven playbooks for high-growth metros

- Local operators backed by national support

- Technology that enhances—not replaces—decision making

- A focus on transparency, accountability, and maximizing long-term value

2025 is the year to set the tone for the next cycle. Let’s talk about how we can help your assets outperform.

Reach out to Josh Lindley at JLindley@29SC.com for more information.

Follow Us On Social Media